The tech bubble continues to grow. For the steps taken by Goldman Sachs to enter the capital of Facebook social network, now it is the giant JP Morgan Chase. The largest U.S. bank, two weeks ago created a specific fund to invest in firms in the digital age, wants a slice of the popular Twitter micro blog.

Specifically, elFinancial Times reveals, the entity is preparing to spend $ 450 million in the dot-com through Digital Growth fund to take over 10% of the capital. That is, the bank would be valued at 4,500 million Twitter. It, along with Facebook, LinkedIn and Groupon, a company that is generating more enthusiasm on Wall Street.

Analysts valued last year at the end of Twitter in 3,700 million estimate was made after Kleiner Perkins Caufield & Byers invested $ 200 million. And just over two weeks, The Wall Street Journal revealed that Google and Facebook were interested to seize the product and could expect to pay around 10,000 million.

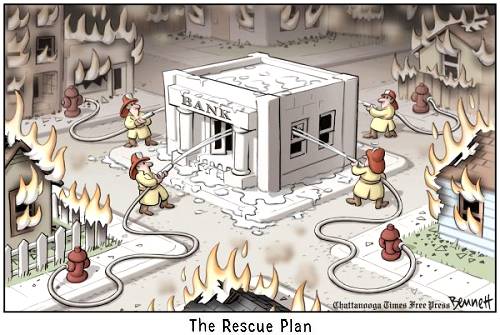

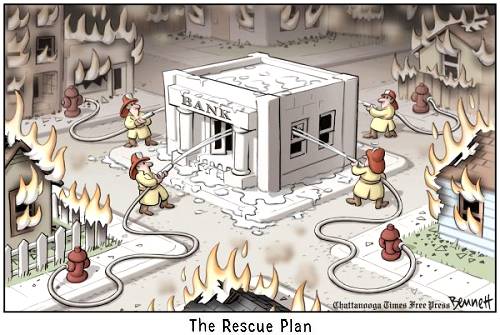

JP Morgan's move is therefore further evidence of the frenzy that dominates among investors, as reflected in private and brokerage platforms SecondMarket, where actions Facebook will pay $ 27, making the company worth about 67,500 million. Goldman Sachs had valued the network of Mark Zuckerberg at 50,000 million.

The Financial Times is not clear whether the money that JP Morgan wants to inject into Twitter will in the form of direct investment or purchase of shares are held by private investors or employees. In either case, the fund would need the approval of the managers of the technology. Not appear, the paper, which will go to the secondary market.

Therefore, there is still no deal struck between the two parties, such as allowing Goldman Sachs to inject nearly 1,500 million in Facebook. Despite strong growth in the last two years, this type of company need a lot of liquidity to continue growing. Another of the ways is to go directly to the market, taking part of capital stock.

JP Morgan, according to information submitted to the U.S. stock market regulator, has 1,220 million ready to invest in other technology such as Skype and Zynga. And as Goldman Sachs, these structures provide significant revenue for banks by the commissions they charge their customers in order to bite the capital of unlisted companies.

Specifically, elFinancial Times reveals, the entity is preparing to spend $ 450 million in the dot-com through Digital Growth fund to take over 10% of the capital. That is, the bank would be valued at 4,500 million Twitter. It, along with Facebook, LinkedIn and Groupon, a company that is generating more enthusiasm on Wall Street.

Analysts valued last year at the end of Twitter in 3,700 million estimate was made after Kleiner Perkins Caufield & Byers invested $ 200 million. And just over two weeks, The Wall Street Journal revealed that Google and Facebook were interested to seize the product and could expect to pay around 10,000 million.

JP Morgan's move is therefore further evidence of the frenzy that dominates among investors, as reflected in private and brokerage platforms SecondMarket, where actions Facebook will pay $ 27, making the company worth about 67,500 million. Goldman Sachs had valued the network of Mark Zuckerberg at 50,000 million.

The Financial Times is not clear whether the money that JP Morgan wants to inject into Twitter will in the form of direct investment or purchase of shares are held by private investors or employees. In either case, the fund would need the approval of the managers of the technology. Not appear, the paper, which will go to the secondary market.

Therefore, there is still no deal struck between the two parties, such as allowing Goldman Sachs to inject nearly 1,500 million in Facebook. Despite strong growth in the last two years, this type of company need a lot of liquidity to continue growing. Another of the ways is to go directly to the market, taking part of capital stock.

JP Morgan, according to information submitted to the U.S. stock market regulator, has 1,220 million ready to invest in other technology such as Skype and Zynga. And as Goldman Sachs, these structures provide significant revenue for banks by the commissions they charge their customers in order to bite the capital of unlisted companies.

No comments:

Post a Comment